Redefining Venture Capital: The Impact of AI on Deal-Sourcing

As the world grapples with the rapid evolution of artificial intelligence (AI), its implications stretch far beyond the tech space. From the perspective of venture capital, AI represents both a challenge and an opportunity—a dual-edged sword that can shape the landscape of investment practices for years to come. In a recent experiment conducted by Vertex Ventures, the utility of AI in sourcing and evaluating investment opportunities was put to the test, revealing a synthesis of efficiency and potential pitfalls that can redefine how we think about the future of our industry.

A Broader Perspective on AI

In preparing for a panel discussion on the multifaceted aspects of AI, I recognized the complexity surrounding its definition—varying widely across sectors and stakeholders. AI’s application in the venture capital realm demonstrates this diversification. While some view AI as an advanced tool for enhancing workplace productivity, others perceive it as a growing threat to traditional job roles and decision-making processes. The perspectives surrounding AI’s role are not only fascinating but crucial in understanding its potential trajectory.

As stated by the renowned science fiction author Ted Chiang, AI could be likened to “a blurry JPEG of the Web.” This metaphor underlines the limitations that still constrain AI technologies, juxtaposed against the enchanting concept of “emergent capabilities.” The unpredictable behaviors exhibited by larger language models (LLMs) often beg the question: what does AI truly mean for us?

Exploring the interface between AI and investment strategies

Expanding Deal-Sourcing Horizons

The journey towards integrating AI into venture capital practices commenced during one of our strategic meetings aimed at enhancing deal-sourcing capabilities. Historically, our leads predominantly came through established networks. However, aiming to broaden our venture scouting landscape, we discussed innovative solutions; one involved utilizing interns as research assistants to comb through job platforms for promising startups. This idea naturally led to a larger question: Could AI replicate this analytical exercise more efficiently?

Fast-forward eight months, and we successfully embedded a robust AI model into our routine workflow that screens thousands of firms from platforms like LinkedIn. Our system analyzes key metrics—such as company size, follower counts, and website traffic—to produce a targeted list of potential investment opportunities. This shift in approach marks the beginning of a promising new era in our evaluation process, where speed and precision marry to create optimism among our team.

Measuring AI’s Effectiveness

To make the most of AI, one must begin with clear and realistic objectives. It’s critical to understand that while we leverage advanced technologies, we’re still far from achieving artificial general intelligence. Our intent was never to replace the forensic scrutiny of human analysts but rather to alleviate their workload by eliminating tedious tasks. In essence, the AI serves as an efficient intern, generating insights from expansive datasets.

A key takeaway from our experience is the importance of measuring outcomes. As the old maxim advises: “If you can’t measure it, you can’t manage it.” For my team, that meant assessing the quality of leads produced by our AI initiative compared to our traditional approach. Feedback has so far been promising, evolving into a centralized data repository that not only aids research but also cultivates informed decision-making regarding which leads warrant further investigation.

Navigating Design Challenges

In constructing our AI-driven system, we faced a pivotal choice between a modular and an end-to-end design. A modular system involves breaking down the process into components and refining each independently, which permits meticulous adjustments but might overlook nuanced interactions between various parameters. Conversely, deploying an end-to-end system allows the AI to assess the entire process as a cohesive unit.

Given the advancements in transformer architectures, we pursued an end-to-end system. Encouragingly, it has exhibited surprising capabilities—one could describe its decision-making process as “intuitive reasoning.” We are constantly amazed by the AI’s ability to navigate the complexities inherent in venture capital, redefining the patterns through which we identify opportunities.

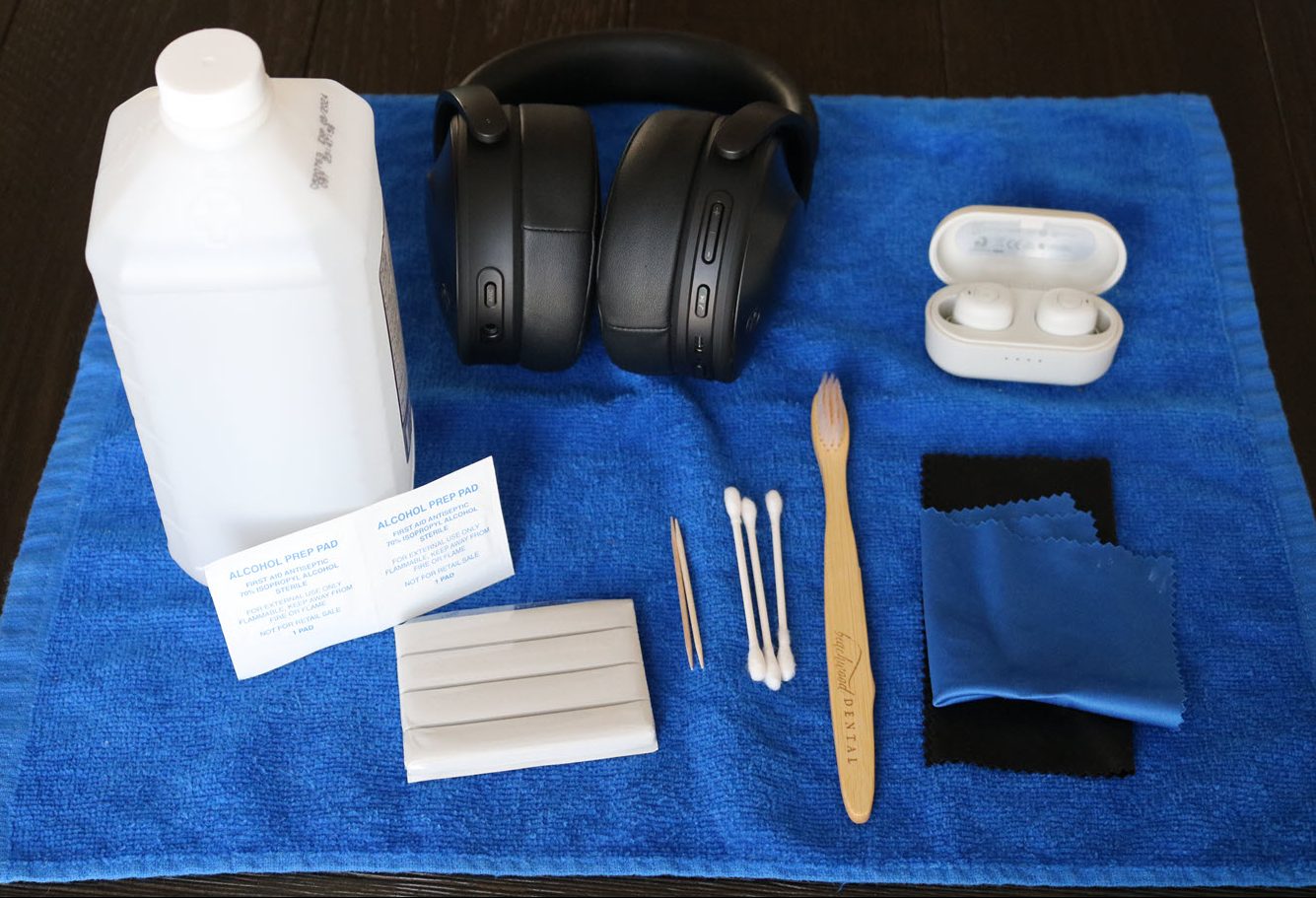

Venture capital landscape marked by innovation

Venture capital landscape marked by innovation

Pushing the Boundaries of AI’s Role

While the current capabilities of AI are encouraging, our journey is only beginning. Having dabbled in advanced prompt engineering techniques, our team has delved into methods like few-shot learning and chain-of-thought reasoning. Experimenting with various AI frameworks has been enlightening, though substantial hurdles remain. Deal sourcing, while pivotal, is merely the surface of a much deeper set of intricate tasks awaiting integration with AI, including investment management and post-investment analytics.

It’s apparent that while AI is unlikely to fully supplant human roles in the near future, its role as an enabler of productivity is undeniable. In cultivating our integration of AI tools, we are not simply optimizing our processes; we are also refining our investment thesis, enhancing our value proposition for AI-centric portfolio companies.

As AI continues to evolve, so too will our strategies and approaches. The journey may be long, but this transformative technology has the potential to elevate our practices and lead to groundbreaking insights that reshape our industry.

Visions of AI’s future in venture capital

Visions of AI’s future in venture capital

With each advancement, I eagerly anticipate how AI will further enhance our capacities in the complex world of venture capital, propelling us into a new frontier where technology and investment meet.