Navigating the AI Landscape: Banks, Generative Capabilities, and Cognitive Collaboration

As the banking sector grapples with the pressures of innovation, the dialogue surrounding artificial intelligence (AI) is intensifying. The integration of generative AI technologies like large language models (LLMs) is shaping a pivotal moment in financial services, where the demand for efficiency meets the complexities of infrastructure adaptation.

Banking and artificial intelligence: A transformative partnership.

In a climate punctuated by claims of groundbreaking advancements, it’s essential for banks not just to adopt AI but to redefine their strategies and governance. As David Bholat, a prominent figure in AI consultancy and former Bank of England manager, suggests, the focus should be on quality integration over sheer quantity.

The Rise of Generative AI in Banking

Banks are gradually shifting from traditional operational models towards a more integrated AI approach. While many early adopters began by leveraging platforms such as ChatGPT or Microsoft Copilot, scaling these technologies exposes a more intricate web of challenges. Nick Kramer of SSA & Company notes that the effective utilization of generative AI requires firms to go beyond off-the-shelf solutions and explore tailored AI models that meet their unique needs.

These advancements herald opportunities for banks to produce executive summaries and create marketing content efficiently. Yet, as organizations look to incorporate AI deeper into their processes, they confront the limitations of public cloud infrastructures and the complexities of data management.

Infrastructure Challenges of Scaling

TA cornerstone of generative AI adoption, organizations typically rely on enterprise-grade accounts with cloud-based services. However, as firms ramp up usage, infrastructure challenges are becoming more pronounced. In its latest report, Deloitte states that 75% of companies in the AI space are upping their investment in data lifecycle management, recognizing that navigating the cloud’s complexities is critical for leveraging the full capabilities of these technologies.

As more banks transition to these advanced technologies, there’s a clear recognition that simply deploying AI isn’t sufficient. To stand out in a crowded marketplace, institutions must devise innovative applications that utilize AI not just as a tool but as a partner in driving new directions of thought.

The Cognitive Partnership: AI as a Thought Partner

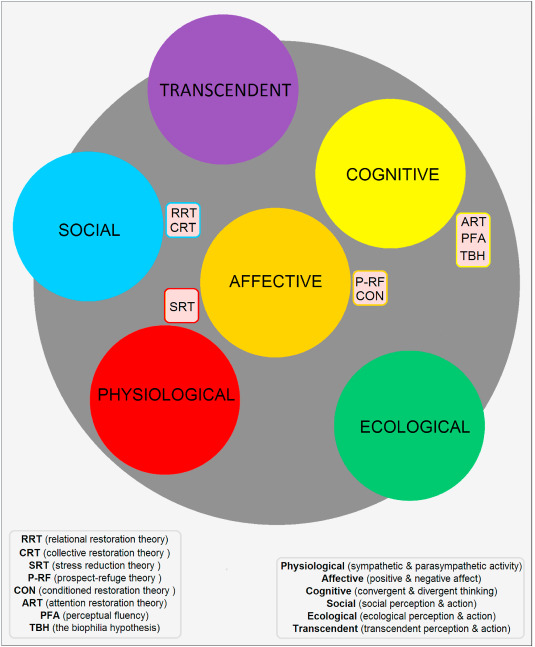

The relationship between humans and LLMs extends beyond the traditional dynamics of user and tool; it evolves into a cognitive partnership where both entities actively engage in the thinking process. Philosophers like Andy Clark advocate for the notion of an “extended mind,” suggesting that our cognitive processes can be enriched by the tools we utilize. This perspective is particularly salient as LLMs serve as partners that not only respond but enhance our cognitive abilities.

The interplay between humans and AI fosters a unique “cognitive dance,” where ideas and problems are iteratively refined through dialogue. By presenting initial thoughts and receiving reflective feedback from LLMs, users find themselves engaged in a dynamic pattern of thought that neither could achieve alone. This collaboration leads to deeper inquiry and sparks fresh insights across the spectrum of banking operations.

Exploring the new dimensions of thought facilitated by AI.

Exploring the new dimensions of thought facilitated by AI.

Redefining Knowledge and Reasoning in Finance

Through interaction with LLMs, individuals must articulate their thoughts with greater clarity and engage in structured reasoning. In doing so, LLMs act as metacognitive mirrors—forces that compel users to scrutinize their internal processes, thus enhancing understanding and refinement of ideas. This interaction urges a reconsideration of how knowledge is structured and processed in an increasingly complex world.

In a setting where traditional information hierarchies are being dismantled, we are transitioning to a more fluid framework of understanding. Human cognition is being reshaped—fluid networks of meaning are replacing static categorizations. What this suggests for the future of banking and finance is profound: the convergence of human intelligence with AI could lead to unprecedented forms of innovation and insight capacity.

Confronting Challenges While Embracing Opportunities

As banks stand at a crossroads of opportunity and complexity with generative AI, it is crucial to pursue a model of governance that prioritizes not just technological footprint but also ethical considerations. Institutions must ensure robust frameworks that manage risks while fostering an environment where innovation can thrive. The role of digital governance will be paramount in addressing the myriad challenges posed by rapid technological advancements.

As we look ahead, the future of artificial intelligence within the banking sector holds the potential for radical transformation. Through thoughtful integration, governance, and a commitment to understanding the cognitive implications of AI, banks can cultivate environments ripe for innovation. This will enable them not only to adapt but to lead in an era characterized by rapid evolution and growth.

Conclusion: A Future Intertwined with AI

In sum, as banking institutions navigate the complexities of AI deployment, there lies a wealth of potential in reimagining relationships between thought and technology. The path forward is one of exploration and adaptation, where financial leaders will not only embrace generative capacities but will also thoughtfully consider their implications for knowledge and governance in the digital age.

As we embrace this exciting frontier, the banking sector must remain vigilant in pursuing innovative pathways to ensure sustainable growth and transformation that aligns with evolving consumer needs and expectations. The harmony between human and artificial intelligence is not merely a fleeting partnership but a trajectory of shared evolution.

Envisioning the future of financial services with AI.