The AI Revolution: Navigating the Investment Landscape

The world of finance is abuzz with the potential of artificial intelligence (AI), a sector forecasted to eclipse $1 trillion by 2027. According to recent forecasts, this astronomical growth presents investors with what UBS refers to as possibly one of the largest investment opportunities in human history. As I look at my own investment strategy, I can’t ignore the implications of this seismic shift towards AI technology.

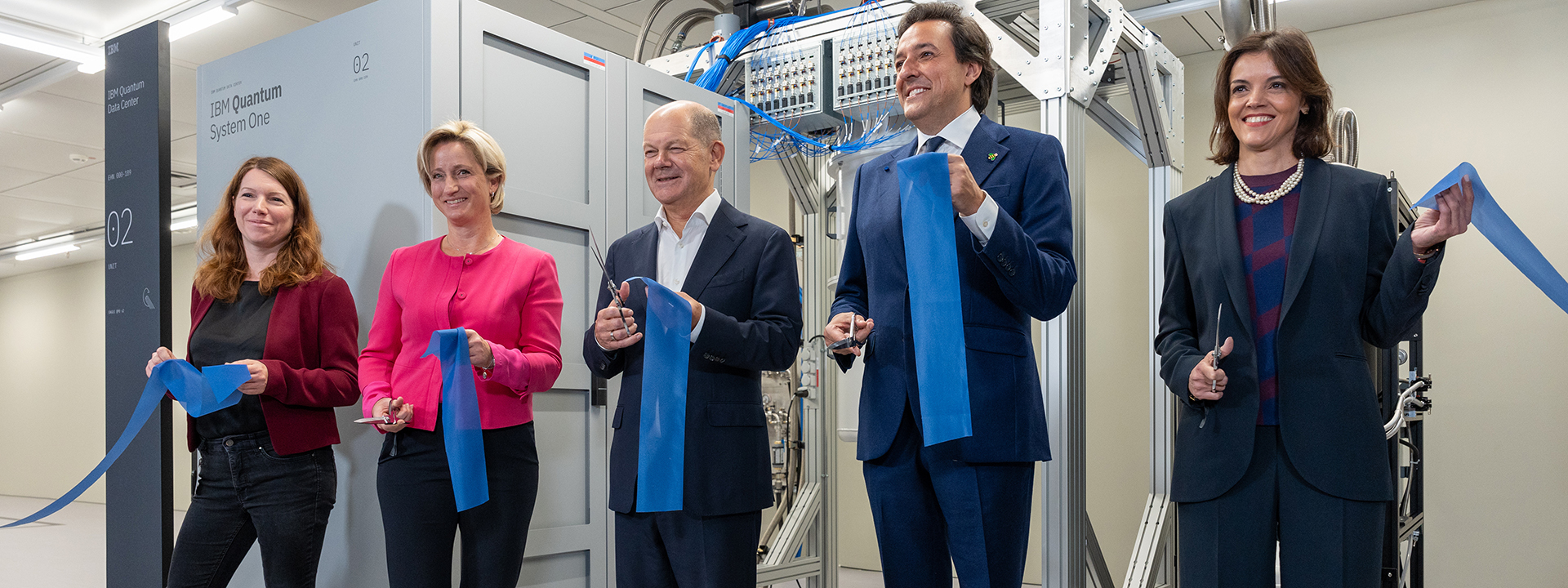

An exploration of the vast potential in the AI market.

An exploration of the vast potential in the AI market.

The AI Ecosystem Unveiled

To truly capitalize on this booming sector, it’s crucial to understand the AI industry as a tripartite structure comprising enabling technologies, intelligence systems, and applications. This intricate value chain highlights the interplay of various components driving AI development and adoption. I find it fascinating how all these elements are interconnected and crucial for an investor’s strategy.

Step 1: Ensure Adequate Exposure

One essential takeaway from UBS’s analysis is the importance of investing enough into the AI sector. While it might seem straightforward, properly weighing our investments in AI is key to harnessing the industry’s growth potential. Personally, I’ve increased my allocations to tech and AI-focused ETFs because I believe they’re positioned well to benefit from this incoming wave of investment.

Step 2: Focus on the Enabling Layer

Diving deeper, UBS highlights the “enabling layer” as a prime target for investment. Last year, companies like Nvidia, Dell, and Broadcom saw tremendous stock price increases, largely driven by their roles in providing essential AI infrastructure. Their growth stories resonate with my belief in investing in companies that are not just sounding bells but are actually building the frameworks upon which future AI technologies will run.

Key players in the hardware sector driving AI development.

Key players in the hardware sector driving AI development.

Step 3: Big Tech is Here to Stay

When considering major players, the dominance of Big Tech cannot be overlooked. They are pivotal in advancing AI technologies, deploying billions annually. Companies such as Google, Microsoft, and Amazon have not only committed significant resources to AI, but they also boast the scale to conduct extensive experiments and innovations. I find solace in the fact that these companies are likely to maintain their competitive edge due to their established ecosystems.

Step 4: Look Beyond Borders

Interestingly, while many think of AI advancements as primarily American, UBS suggests that some of the most promising opportunities might exist overseas, particularly in places like China. With giants like Alibaba making substantial investments in AI startups, the international landscape offers a rich array of options that shouldn’t be ignored. My recent foray into not only US stocks but also international funds underscores my recognition of the global nature of this opportunity.

Conclusion: Embrace the Change

As I consider the implications of these insights, I feel enthused about embracing the changes that AI heralds for the investment world. The sector’s unprecedented growth is a clarion call for any serious investor. The foundation we lay now—through understanding the AI value chain and recognizing the key players—could pave the way for long-term financial success in this transformative epoch.

In summary, navigating the AI investment landscape is not merely about purchasing stocks but about building a robust understanding of the ecosystem surrounding this technology. By adhering to a strategic approach as outlined by UBS, I firmly believe investors can unlock substantial opportunities as the AI revolution unfolds.

Exploring the international dimensions of the AI market.

Exploring the international dimensions of the AI market.