Lucas GC Limited: A New Era for a Technology Pioneer

As the competitive landscape shifts, Lucas GC Limited (NASDAQ: LGCL) emerges as a critical player in the technology-driven Platform-as-a-Service (PaaS) sector. Renowned for its cutting-edge solutions in human resources, insurance, and asset management, this company has just released its financial results for the first half of fiscal year 2024, and the numbers are sending ripples through the market.

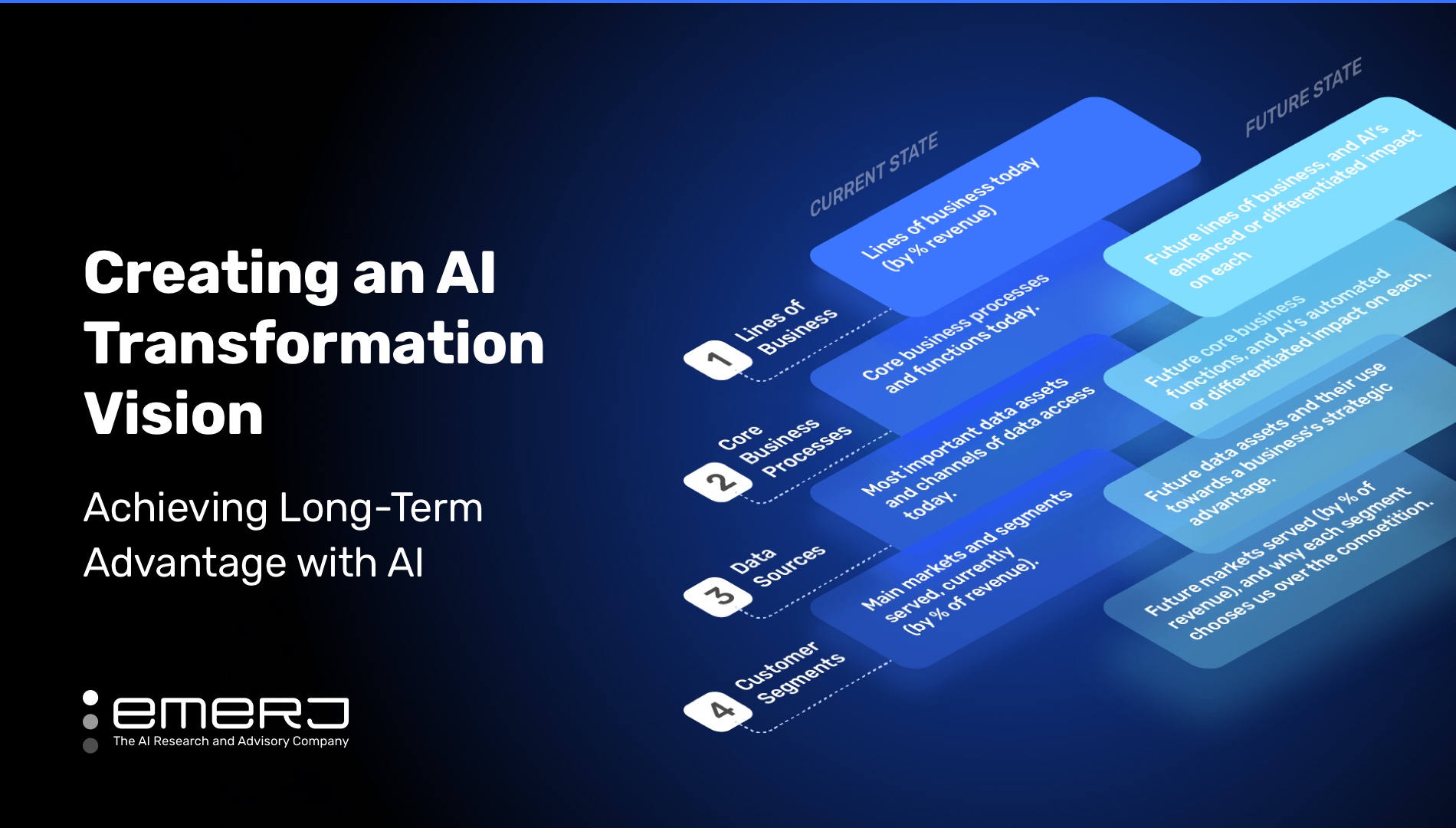

The evolution of technology and its impact on market dynamics.

Key Financial Metrics: A Mixed Bag

Examining the financial results for the six months ending June 30, 2024, we see a significant revenue figure of RMB605.52 million (approximately US$83.32 million). While this marks a substantial decrease of 26.16% from RMB820.07 million last year, it is essential to contextualize these figures within the broader industry trends. Falling revenues are not uncommon in today’s volatile market, influenced by global supply chain issues and shifting consumer behaviors.

However, attached to these disappointing revenue figures is a silver lining: gross margin has increased to 33.54%—a 516 basis point improvement year-on-year. This is an essential indicator of the company’s operational efficiency, particularly as margins are tightening across the board in many sectors. Furthermore, net income has shown a slight uptick to RMB53.93 million (US$7.42 million), translating to a net income margin of 8.91%—an encouraging sign compared to 6.55% last year.

Growth Amidst Challenges: User Engagement

While the monetary aspects may appear daunting, Lucas GC has reported a 10% growth in registered active users, totaling 702,060. User engagement is a vital metric, one that often speaks louder than revenue figures in the tech sector. This increase hints at the robustness of their platform and suggests that consumers still see value in the services provided.

Understanding user dynamics in a shifting digital landscape.

The technological innovations that Lucas GC has pursued are underscored in their patent holdings. With a total of 18 patents in the fields of artificial intelligence, data analysis, and blockchain technologies, the company is positioning itself to lead in these transformative spaces. Recent strategic agreements with publicly traded financial institutions like Bank of Ningbo and Industrial Securities Co., further reinforce their endeavors to innovate and expand.

A Change in Strategy Reflects Insightful Leadership

In a bold move, Lucas GC’s CEO, Howard Lee, has acknowledged the necessity of evolving the company’s strategy. He indicated that the shift towards a more pronounced technological focus has led to a significantly enhanced gross margin. The management’s recognition of the need for change, especially in a fast-moving tech environment, is commendable. It underscores a proactive approach that many companies could learn from, as adaptability becomes vital in securing a business’s longevity.

“Our commitment to technology and innovation is unwavering,” says Lee, emphasizing the essential nature of evolution in the business world.

Future Outlook: Investing in Technology

Looking ahead, Lucas GC Limited aims to maintain its position as a leader in the tech landscape while increasing investments in research and development. This commitment is not merely about expansion; it reflects an understanding that the landscape evolves rapidly and the best defense against competition is continuous innovation.

As technology continues to reshape both consumer expectations and business capabilities, companies like Lucas GC are poised to navigate these changes if they continue adapting and evolving strategically.

The limitless potential of technology in reshaping business landscapes.

In conclusion, although the challenges are evident, the opportunities for Lucas GC are also significant. Their ability to pivot and focus on technology could very well define their next chapter. As they enhance their offerings and optimize performance, it’s clear that the watchful eyes of analysts and investors alike will remain keenly fixed on their journey ahead.

For more information about this tech powerhouse, you can visit Lucas GC.